EOC FINANCE TIPS, TRICKS AND CHECKLISTS

Emergency responses to flood and fire seem to have become the norm in BC in the spring and summer months now…

Before Any Events – The Finance Section Heads and staff might want to equip themselves with a toolkit – to be ready to go. Travel with a USB stick or paper files with the following:

Phone numbers – home, cell & office numbers of staff you may need to call in (numbers for all staff in your organization are handy as you never know whose expertise the EOC may need and what level of activation will occur!) EOC callout lists usually exist, but you usually need to find your staff FAST.

Resource Guides – Know where to find the Guidelines for Reimbursement:

Emergency Management BC (EMBC) Reimbursement and other Information:

-

- Eligible and ineligible costs are discussed in the Guide “Financial Assistance for Emergency Response and Recovery Costs” -- Figure 6 is especially useful.

- The “Community Disaster Recovery Guide” is also located here.

http://www2.gov.bc.ca/gov/content/safety/emergency-preparedness-response-recovery/local-emergency-programs/guidelines

Office of the Fire Commissioner / BC Wildfire Service Reimbursement for resources or apparatus, the rates and claim information for fire apparatus and resources is located here:

http://www2.gov.bc.ca/gov/content/safety/emergency-preparedness-response-recovery/fire-safety/wildland-urban-interface-fire-information

Form Templates – (These should be in the EOC, however we also keep copies) - The two the RDCO uses the most:

- EOC Form 530 – Expenditure Authorization Form (EAF) – When your Logistics/Purchasing team or local government is sourcing the request and a claim will need to be submitted for reimbursement. Note – we have modified the form slightly for better communication between our Ops and Logistics Sections as needed.

- EOC Form 514 – Resource Request (RR) – When you need PREOC to source the resource for you. These are typically not resources you will pay for directly. For example, we fill these out during fires, when we are requesting additional apparatus from fire departments outside of the event area (even if it is within our region, but other jurisdictions within the region respond and those firehalls can be reimbursed, we fill these out.) During the floods we requested BC Wildfire Service (BCWFS) crews for sandbagging, etc. Typically, anytime where EMBC, BCWFS, or OFC will be paying the supplier directly.

- EOC Sign In/Out Sheets – The Planning Section has these at the door (Name, Organization, Time In, Time Out) – we use these for calculating estimated EOC overtime for reporting on the Daily Expense Reports, and proof staff were in the EOC.

Spreadsheets Templates:

Master Tracking Sheet to track Expenditure Authorization Requests (EOC Form 530 which we have modified slightly to suit Logistic’s needs) & Resource Requests (EOC Form 514). This spreadsheet has the following Columns:

If there are multiple jurisdictions affected – use a regional approach, so staff can be interchangeable and everyone can track information for each other.

You can easily filter by government jurisdiction, approval status, vendor, EAF or RR number, or Date it was entered on the EOC Daily Expenditure Report, etc.

Daily Expense Reports – Each day you need to send PREOC Finance a report, and you will need to be able to add these up quickly, as well as have a summary for event totals.

Overtime Calculation Spreadsheet – for estimating overtime for local government staff in the EOC and the field for the Daily Expense Reports (This is reimbursable and PREOC needs to have an estimate of what they will have to pay each day).

Scanned Copy of Blank Forestry Daily Time Reporting (DTR) Form – you may need to distribute copies to your fire departments if the BC Wildfire Service DTR Books are not available. These are key to getting reimbursed by OFC for fire crews, and must be signed off by a delegate from OFC in the field.

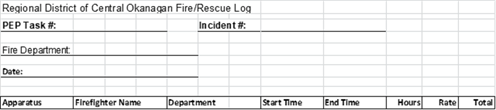

Template of Apparatus Tracking Sheet for Paid on Call Fire Departments – At the very least, have your chiefs complete a sheet that shows the apparatus, who was on it and time in/out for each firefighter

So you have your USB Toolkit, and you have been called out to the EOC

Staffing: You arrive and find out what is happening. Prioritize and assess your staffing needs:

How Many & Who?

Typically, we find we need 2 positons: a Section Chief and just one other person to do Time/Costing. For the initial call out, staff should be experienced, good at setting up systems and adaptable. Afterward, we have found, as we rotate staff through, it works well if each local government has a main anchor in the position that is going to be the one responsible for processing the claims. For long events, we have a lead Section Chief that coordinates and communicates with all Finance staff from all the local governments involved, for continuity purposes throughout the event. For shorter events, the local government Section Chief takes over and can call on others for relief. Our Section Chiefs are typically CFO’s of the regional local governments. This is particularly important on long events given that these events can run in the millions of dollars in claims.

Tip: To reduce the strain on resources, we occasionally backfill staff at the office with casuals so that we can fill the EOC positions with experienced staff. (Be sure to submit an EAF to PREOC for approval.) We have also brought in retired staff with EOC experience to relieve staff during summer vacation peak time.

Processes:

Working with EOC Logistics Section:

When the first EAF’s and RR’s start rolling in from the Ops and the Fire Desks. They typically determine what is needed, and fill out the EAF’s and RR’s and provide as much detail as possible to Logistics via the form.

Finance works together extremely closely with Logistics, and is physically located side by side in our EOC. The staff in the key positions in Logistics have extremely strong purchasing backgrounds. They come equipped with lists of suppliers and contact information as they need to be able to provide resources fast. To make the claim process easier down the road, Logistics:

- Assigns a number to every EAF or RR. We quote this number when dealing with PREOC/EMBC and following up, and making our claims (similar to a PO number). We use different blocks of numbers for each event and further differentiate between EAF’s and RR’s – if there are multiple events going on, this eliminates confusion and makes it clear which event the EAF’s and RR’s are for. Suppliers quote the numbers when invoicing, and this number is used for tracking invoice over-expenditures on EAF’s.

- Has purchasing cards with adequate limits to pay for expenses where suppliers won’t invoice. Be able to increase those limits if necessary.

- Has their own tracking spreadsheet which includes supplier information and other details which we often end up referring back to when making claims.

- Tells the supplier to be sure to quote the EAF number on their invoice if they want to get paid.

- Instructs the supplier which local government to invoice in a multi-jurisdictional event, and who to send the event invoices to. Note: If you are a regional government, each municipality should be paying its own invoices and making claims for the expenses they incur, and the Regional District should cover only the truly regional expenses and those of the Electoral Areas.

General Processes & Tips for Gathering Claim Information During the Event:

- Set up a separate G/L code for each event to hold costs that you are going to be claiming – charge all overtime, staff backfilling and invoices here for easy reconciliation.

- EAF’s and RR’s:

- Number your EAF’s and RR’s -- With 5 different local governments within one EOC for the flood event and fire events, assigning numbering became important for communication, over-expenditure tracking and invoicing:

- Do not duplicate numbers across events – when communicating or following up with PREOC, it helps if it is immediately clear which event it was for.

- Have the suppliers quote the EAF number on their invoices.

- Set up systems to try to ensure that invoices do not get paid twice by different local governments. Communication is key.

- Insist the supplier show the correct local government name/address on the invoice (don’t just trade invoices between muni’s) so there are no GST issues down the road.

- Finance records, scans, and sends EAF’s and RR’s to PREOC for Approval. Attach as much detail and quotes if possible to speed up the approval process.

- Place scanned copy of EAF’s & RR’s sent to PREOC onto a common drive so Ops, Logistics and Finance can all see them. These are also used by Finance when making the claims.

- Once approvals are received, also save them to the common drive so everyone can view them, work can proceed, and everyone can see any limitations PREOC has put on the work. (Be sure to advise the other sections of any limitations so they are aware). Make sure you get an “official” approval document – not just a verbal approval.

- Submit Daily Expenditure Reports to PREOC for the day prior - Use the EAF amounts, and for Overtime estimates, use the sign in sheets each day to estimate how much OT has been worked by local government staff in the EOC (make sure people sign in and out!!!) Also obtain OT estimates from the field or municipalities.

- Incident Numbers and Claims – Try to have each jurisdiction pay their own invoices and then have EMBC pay these other local governments directly wherever possible. (Try not to issue invoices to each other, then pay each other then make the claim – cut out the middleman!) Just because an incident number is in another area, it doesn’t mean that another local government can’t make a claim for expenses it paid for under that number. As long as there is an approved EAF, the claim can usually be made.

- The first operating period of an event can be the most contentious. If it is a fire, the switch over from Mutual Aid to getting the approval for Provincial funding can be controversial. Make sure there is clarity as to exactly when this switch over occurs – enlist the assistance of your Liaison Desk in determining this.

- Every event some of the rules and requirements from the province change. That is the single biggest frustration.

- General EAF’s for the EOC: Meals, supplies, Overtime for the EOC. We have a bit of a trust issue here. Depending on the event, we have been told by EMBC that EAF’s are:

- a) not required, just include everything on the Daily Expenditure Reports,

- b) required (in which case we do blanket EAF’s for a few days)

- c) are partially required (i.e. not for overtime, just meals and supplies).

Get it in writing from the Director of PREOC for each event. Generally, we get a lump sum EAF for a few days that covers meals, and one that covers specific types of supplies or services (cleaning or security).

- Firefighter /Responder meals – Always do EAF’s. Timing can be an issue. It also depends on the event. There is often controversy or denied requests, especially in the first few operating periods of an event. Seek clarity.

- Fire Apparatus Claims for other jurisdictions (Office of the Fire Commissioner Claims):

- Make sure the EOC Fire Desk is completing Resource Requests for apparatus / equipment requested and deployed, and send those in to PREOC/OFC for approval and clarity.

- Fire Department Deployment – MAKE SURE THEY HAVE CLEARLY BEEN REQUESTED by OFC/BCWFS, and sign off has been and approved or they won’t be reimbursed. If you are making claims to OFC, make sure you have them complete and submit copies of DTR’s (Daily Time Reports). At the very least, prepare a spreadsheet template that shows the apparatus and event and time deployed and who was on what unit. We have been told – DTR’s are a requirement for reimbursement by OFC.

- Fuel: you will often need to order and deliver fuel to the site. OFC/BCWFS pay an all-in rate for trucks, which means you will not be reimbursed for fuel. Most fire departments are quite happy to pay for the fuel in order for them to receive the all in rate. So that means you will need to have a system in place with your supplier to track fuel so you can invoice it back to other local governments. Note: So while you can’t put in a claim for fuel, you CAN prepare an EAF and claim the delivery costs of the fuel from EMBC. Make sure Logistics finds a fuel supplier that will work with your incident command to track the trucks (by license plate and description) that were fueled up and the litres and type of fuel!

- Contractors: PREOC says they will only pay up to Blue Book Rates. If rates in your area are higher than Blue Book due to the economy, you need to make your case and try to get this exception approved in advance, at the time the EAF is approved.

Tips for Making the Claims:

- A/P and Invoice approvals – Be wary of making duplicate payments when other jurisdictions within the region are involved. Suppliers may send invoices to more than one place.

- Ensure you are monitoring and tracking the invoices against the approved EAF’s. If they go over approved amounts, go back to PREOC and get approvals for the overages!

(We make this spreadsheet available to the other muni’s so they can use it to check for duplicate invoices).

- Process the EOC invoices in separate A/P batches – they are easier to review this way.

EMBC: Use the EMBC “Response Claim Submission Form”.

- For longer events, submit monthly “interim” claims. List each individual charge, payroll for each employee for each day worked, accounts payable for each supplier invoice, purchasing card for each individual slip item. Attach the following backup:

- General ledger printout for all payroll, accounts payable, etc. charges listed in the claim.

- Copy of EAF for each expense

- Copy of Approval for each expense

- Depending on type of expense, attach the following:

- Payroll – Overtime & Backfilling:

- Timesheet,

- Transaction Register (name, OT wages, rate of pay, amount).

- Response Claim submission spreadsheet employee listing tab indicating name, title, regular/time & half/double time rates, regular hours per day, regular days per week.

- Exempt Staff OT policy, Union Contract OT provisions.

- Accounts Payable Items:

- Vendor invoice showing GST rebate subtracted

- Proof of payment (cancelled cheques/EFT bank printout)

- Purchasing Card Items:

- Statement

- Original purchase receipt (not credit card slip just showing payment), showing GST rebate subtracted.

For OFC Claims, use the forms referenced on their website, and be sure to include copies of the signed off Daily Time Reports and list the apparatus and firefighter information specified.

That’s it! That’s all the tips and tricks I can think of. Every event will be different. There is a lot to be aware of, and there are resources available to you. Also use the best resource you have - the creativity of your team to come up with tracking solutions that work for you…

AUTHOR: Marilyn Rilkoff is the Director of Finance and Administrative Service, Deputy CAO, at the Regional District of Central Okanagan where she worked for 15 years. Marilyn’s background also includes having worked for an electric utility, an internet news service, CRA, manufacturing and commodity futures trading companies.